This post, I admit, is aimed pretty squarely at senior executives, but hopefully others can follow along as well.

As an executive, how would you decide between projects that could: a) improve retention; b) increase growth; c) protect against a lawsuit or regulatory fine; d) get ahead of debilitating tech debt; e) improve customer love and brand strength; f) build a strategic moat.

Currently, it’s hard to put these items side-by-side. And if we merely examine dollar returns, we don’t take strategy into consideration. So today, exec teams mostly intuit the right path forward because our classic tools like “return on investment” fall short. The fact is, not all dollars are equal — neither strategically nor financially. (if you want some stories relevant to that point, see Financial Fluency: Understanding Valuation)

As a business, what ultimately are we trying to do?

We are trying to become more valuable. Ideally, we accomplish this by doing a great job of serving customers, shareholders, employees, and our community/society. The stories we tell to motivate ourselves with a sense of mission revolve around customers, which is as it should be. But that said, ultimately, we are trying to become more valuable.

How can you make your business more valuable?

One way is to grow your top and bottom line numbers.

Let’s take a simple example: you are a $30M revenue SaaS company valued at 10x revenue. You’re worth $300M before you factor in cash and debt.

If you grow your business to $40M and stay valued at 10x revenue, you are now a $400M company. However, if you can improve your multiple from 10x to 15x, even at $30M in revenue you’re now a $450M company. At $40M, you’re a $600M company. So often our projects focus on the first (get more revenue) while our strategy attempts the second (improve our multiples). We quantify the former but leave the latter intangible.

Sometimes you can get this “multiple improvement” (also called “multiple expansion”) due to external factors, such as the public markets doing well or your space coming into vogue. I want to focus on things that are in your control.

Here are some things that create multiple expansion that are within your control:

- Revenue items

- Growth rate

- Overall size

- Smooth revenue, with predictability and lack of cyclicality

- Lack of concentration

- Profitability items

- Good gross margins

- Healthy EBITDA (or the option for this)

- Other

- Defensibility / moat

- Usage/engagement growth

- Healthy balance sheet

- Premium for market leader

- Premium for strong team

- Premium for fewer “other” risks (cash flow, legal/regulatory, talent flight, etc)

What does this mean for prioritization and decision making?

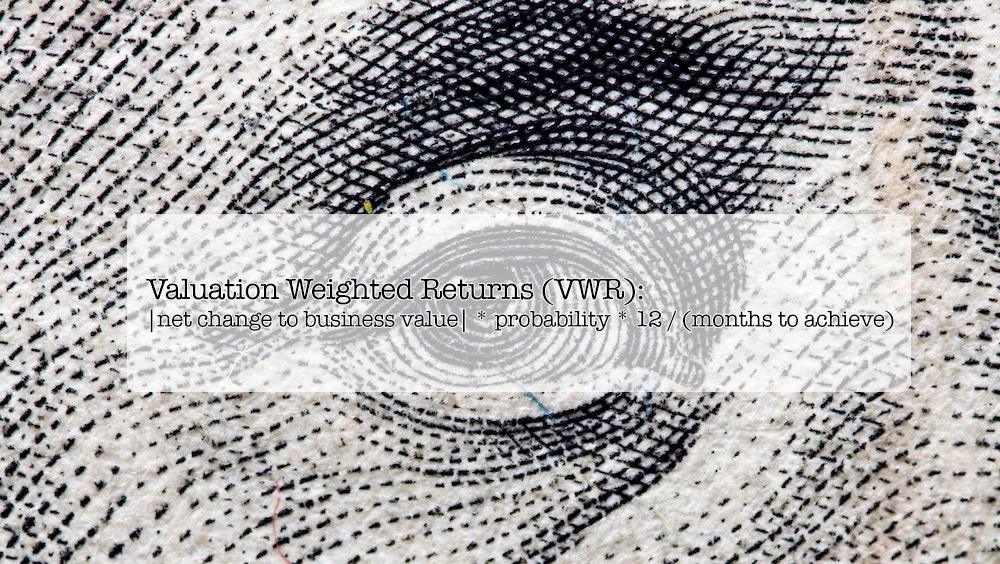

I’d like to propose an alternative to “ROI” analyses for different projects. I’m calling it “Valuation Weighted Return” (VWR).

The formula I have in mind is pretty simple, with 3 parts (A * B * C):

|net change to business value| * probability * 12 / (months to achieve)A: |net change to business value| — The absolute value of the net change to the business value. So if messing up GDPR costs you $50M in the value of your business, that becomes a positive $50M, just like a revenue increase might.

B: Probability — The probability is your best guess on the likelihood you can successfully deliver on the goals, or that an event might occur (like a GDPR fine and PR nightmare)

C: 12 / (months to achieve) — Lastly, we divide 12 by the esimatated months to achieve the net change to business value — this gives a premium to fast-acting projects.

How would that work in practice?

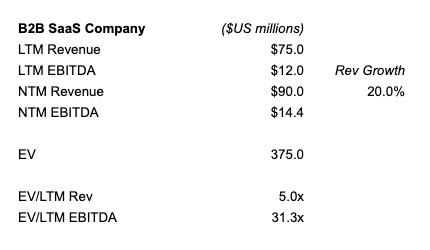

Let’s say that we’re a B2B SaaS company. We’re $75M in revenue, profitable, and growing at 20% a year. Our enterprise value/revenue multiple is 5x.

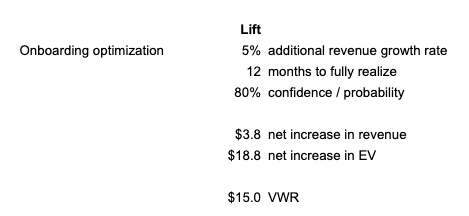

We are thinking about dedicating a team to optimizing our onboarding. We think with 12 months of work, we can add 5% to our growth rate (bringing it to 25%). We’re 80% confident. The Valuation Weighted Return would then be $15M.

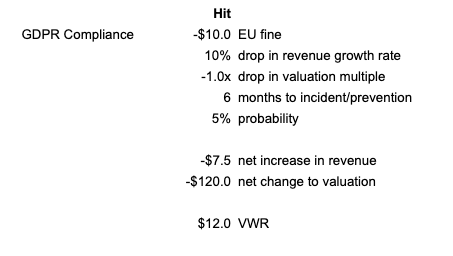

We are also worried about our GDPR compliance. Our General Counsel has been nagging at the team for months. She estimates that we could get hit with a $10M fine from the EU, and the downstream effects could subtract 10% from our revenue growth rate. We guess that the hit plus the impact to overall customer/investor confidence could drop our valuation multiple from 5x to 4x. We think there’s only a 5% chance of this happening. The GC is worried that this could happen this year, and we think that we could actually resolve this risk if we invested in it with about 6 months of work. The VWR here is $12M. However, if we thought there was a 10% chance this could happen, then all of a sudden this becomes worth $24M to us.

My Point

Just saying “we’re going to focus on outcomes” doesn’t actually help us stack things against each other — not if they have lots of different flavors like offensive moves, defensive moves, intangible goals, and adverse events. But if you can translate them into VWR, now you actually have a way to stack things against each other.

Things to Consider

Guesswork: This formula requires educated guesses, but then so do any of the approaches that require us to guess at risk, timelines and returns (which is why discounted cash flows are kind of nonsense for tech companies because the terminal value is pure fantasy land). This is my motivation for keeping the formula so simple — I think mathematical complexity obfuscates and artificially bolsters the guesses we are making. The real benefit of something like this is it forces a conversation — what are our assumptions about how we truly build value and what does that mean for what we do?

But I don’t know how to value a business: The readership of this blog has shifted from entrepreneurs to product leaders, and I’m not expecting most product leads out there to be experts in company valuation. I’ve got the unusual background of having once been a tech i-banker. Earlier in my career, I valued countless tech companies for acquisitions and IPOs, and I’ve even sold a few companies while at the helm. However, I am confident that your CEO and CFO are thinking a lot about how your company is valued. I guarantee your board is, even if they aren’t saying so explicitly. Founders and CEOs learn about this stuff from their investors. You can learn about this topic from them. Don’t be afraid to show your lack of knowledge on this topic. The conversations and improved alignment that will emerge are worth it.

In Conclusion

Far better than strategy, which is unevenly understood and interpreted, finance is the common language across the various functions of a company. It is a great tool to create executive alignment around what to do and why, because it lays bare both assumptions and intended outcomes. My hope with this approach is that more executive teams level up from merely thinking about top-and-bottom line outcomes to thinking about valuation and multiples, which should better align projects with strategy and better justify the essential defensive moves that often get short thrift until it’s too late.

(It’s worth noting that while finance is a great tool to create executive alignment, narrative and storytelling are the best tools to create company-wide alignment.)

If you are interested in this idea and battle test it at your company, please let me know by emailing me or reaching out on twitter (my handle). If nothing else, I think the above can steer conversations (i.e. debates) about prioritization in a more strategic direction.

p.s. when I agreed to teach product management at NYU’s business school, my hope was that it would help me clarify my own thinking. The above post has been a pleasant outcome as I try to figure out why we do the things we do, and how we can we demystify them.

Addendum — Q&A from Twitter/Email

From Regan: How do you help an exec team calculate valuation or multiple risks? I see challenges in connecting say tech debt to revenue, I imagine multiples x years down the road would be even harder.

My response: I would first sit down with the CTO and play out the continued under-funding of tech debt. There are two likely scenarios: 1) at some point things grind to a near halt, or 2) you have to dramatically increase the size of engineering, massively impacting your margins. In scenario #1, I’d think through how much of our hoped-for revenue growth & retention is tied to continued investments in product development — in essence what would happen to the company if you basically fired the entire product & engineering team in 6 months yet had to pay their salary for 2 more years? Would this be a slow slide or a fast slide? In scenario #2, which in some ways is simpler to forecast, you’d take an estimated hit both to the bottom line (with enough tech debt, you could double your engineering size and still only go half the current speed) and take an estimated hit to your multiples due to the reduced profitability and innovation of the company.

Another experienced product leader who I’ll leave anonymous emailed me: “I think we have to be careful about stuff that suggests there’s a way to calculate the right answer. These are tools that provoke discusssion and debate and help form good judgement— it’s just a tool.”

My response: I completely agree. What I find useful about the above is not that it gives precision — attempting that is a fool’s errand — but rather that it allows us to talk through how everything connects to business valuation, in essence putting things on a more even playing field. And it creates a focused conversation around assumptions for the inputs.

Comment from an experienced product lead: My worry is this has the potential to devolve into a spreadsheet-based prioritization process, rather than one guided by a coherent vision of where we’re going.

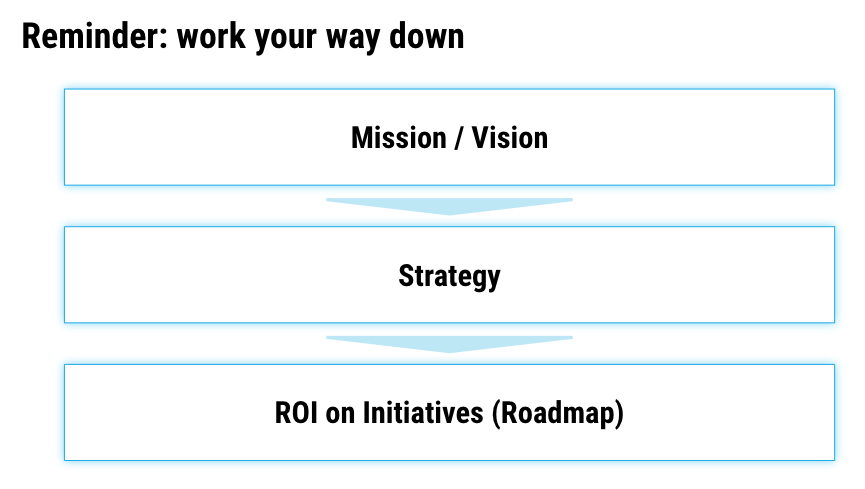

My response: I share that fear. Actually when I shared this with my business school students, I followed it up with the below slide. But I still think by anchoring on valuation rather than purely revenue/profit, we align better with vision and strategy.