I’ve been thinking a lot about the intersection of product and finance given my new class on financial fluency. Product managers, whether an individual contributor or a head of product, get lots of advice on how to start a new job:

- Use the product extensively ✔

- Get to know the customers deeply ✔

- Internalize the company’s strategy and goals ✔

- Learn your team’s methods and values ✔

- Find out who the influencers are in the company ✔

- Find a quick win for the team ✔

The critical addition often missing is this:

- Sit down with someone in Finance and understand how money works in the business ✔

If you’re at a startup, you might talk to the CFO. At a larger company, maybe you talk to someone who reports to the CFO. Below are some questions to ask and at the bottom of the post, I also have advice specific to CPOs/product heads starting a job.

Questions to consider asking:

- What are the most important parts of the income statement to our business?

- What are our financial strengths and weaknesses?

- Are there important aspects to know either about our cash flows or how we use our balance sheet?

- What are the one or two metrics you watch most carefully around revenue?

- Are there aspects to either our gross or operating margin that we are actively trying to change?

- What else about the financials of this company do you wish all product managers here knew?

And of course, don’t be afraid to ask a follow-on question if you don’t understand their answer.

Why do this?

I bet just by reading those questions you already know why it’s important to do this: you’ll have a much deeper understanding of the business model, the company’s state, strategy, and goals. You’ll be able to think about prioritization in a much more sophisticated way. And you’ll show the organization that you think like a business leader.

But what if my culture is tight about financial details?

Most leaders in Finance are thrilled to have a product manager ask to learn more about the finances of the business. Very few people, in any part of the organization, do this! However, some companies can be tight about their finances. If that is your culture, it won’t hurt to have your head of product ask on your behalf. Then Finance will be more likely to give you time and also open up in answering questions. And if your head of product steers you away from Finance, then ask the above questions to your head of product! Ideally they know the answers too.

Advice for new CPOs / Heads of Product

If you are a new head of product, all of the above applies. Your CFO is going to be thrilled to have a partner who takes a keen interest in the financials. Kicking off your relationship with evidence that you make finance a priority — well it’s just a good look, not to mention will make you better at your job. You’ll be glad to have that mutual trust with the CFO when it comes to future asks around incentive systems, spending, growth ideas, or even, sadly, navigating a restructuring.

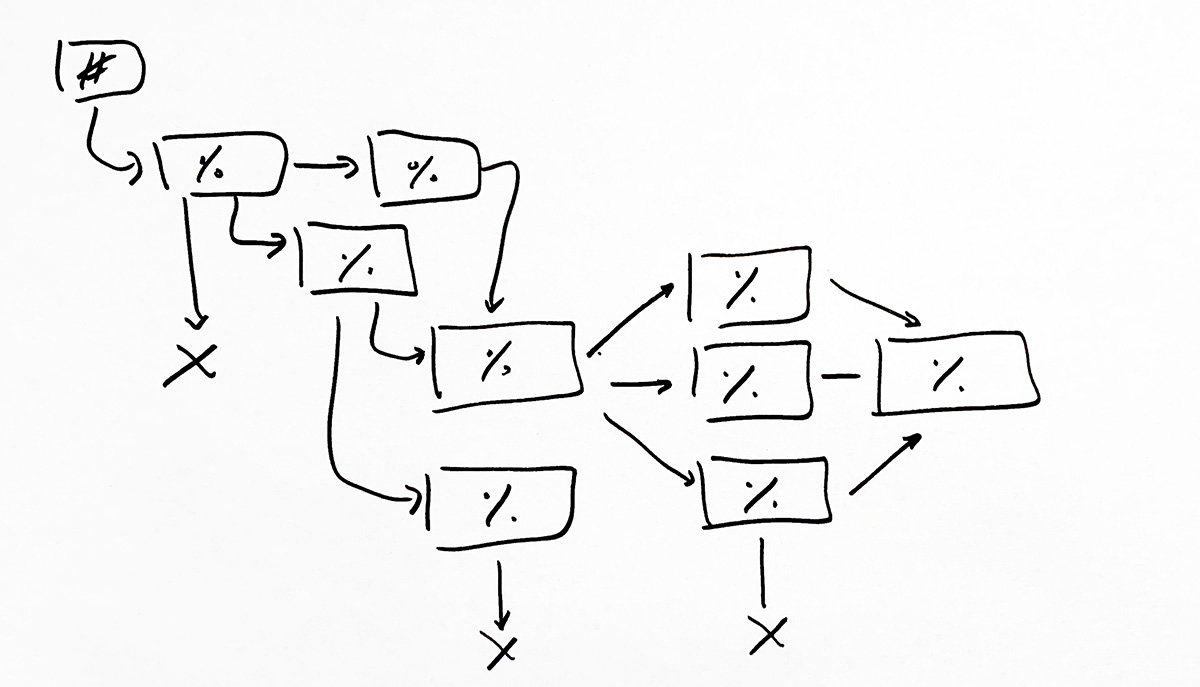

My recommendation is to go beyond conversation. Once you understand the business, get cozy with a spreadsheet and model out your understanding of the product’s full “business model”: how prospects flow in, convert to customers/users, expand in revenue or churn, etc. You want to map out the important parts of your system. When you hit gaps in your knowledge, go get the answers.

I’d recommend one of two approaches: 1. create a 3 month snapshot if you’re trying to understand the mechanisms of the business; or 2. create a model that goes back 12 months and forward 12 months if you’re trying to understand how things are trending.

Do not start with a template — that’s just going to push you into generic FP&A (financial planning and analysis) territory that is too high level — useful to finance and the board but not to you as product leader. Again, this exercise is about creating a blueprint of the system that is the business, with the product anchored in the center. It’s about understanding your logic flows and conversion rates. Start either with a blank sheet of paper or a blank spreadsheet.

Once you have a decent draft, sit down with your CFO and walk through the model, making sure they know it is: 1) a draft, and 2) just a tool you are using to better understand the business, not something you expect Finance to use.

Two things are likely to happen. First, the CFO will help you sharpen the model, thus improving your understanding of the business. Second, you are likely to help the CFO better understand the business too! CFOs are not product people and often don’t have a detailed understanding of how product activity connects to financial outcomes. However, every CFO I’ve ever worked with is interested in this. They all want to think and help the business strategically.

It’s time consuming to do this, but I can’t think of better homework to understand your business, refine your thinking about impact and priorities, and build a great partnership with your CFO.

p.s. if you’re a product manager reading this section, not a product leader, why not turn this is into a group exercise for the PM team? can you make a model of the system that is your product’s business model?